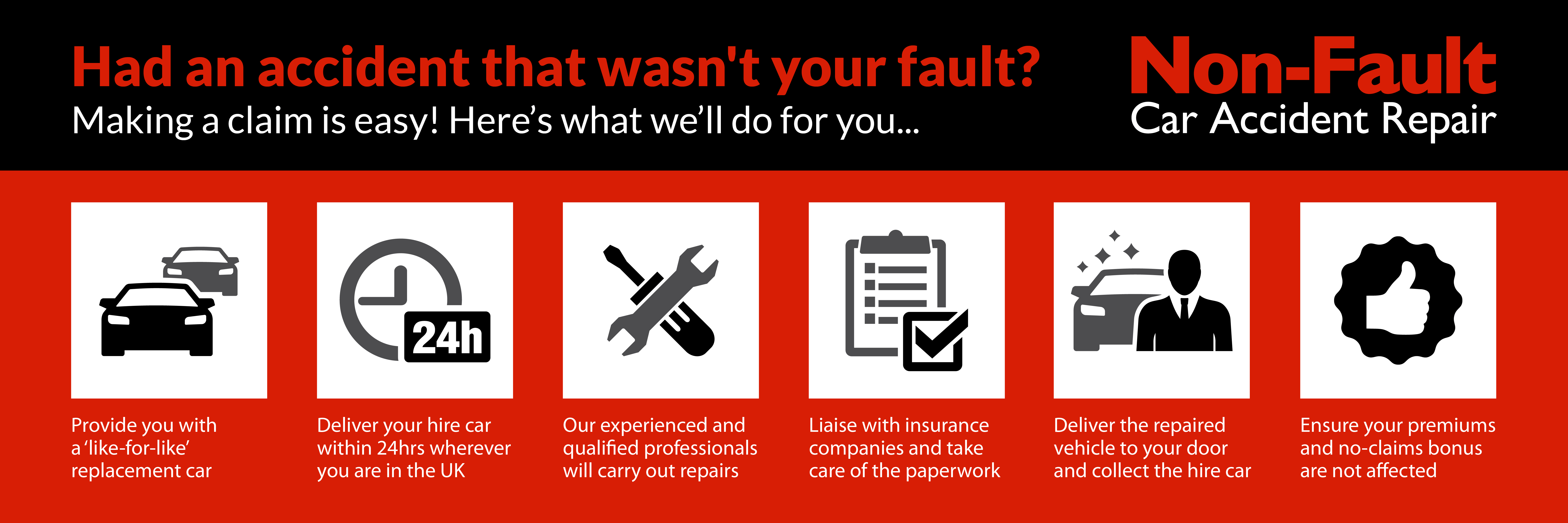

Had an accident that wasn't your fault?

Start your claim here by completing our simple enquiry form

Which car insurance policy is best for you?

With hundreds of car insurance policies on the market, deciding which one is best for you is a real challenge. Read on for some great tips on choosing the best car insurance policy for your driving needs:

What cover do you need?

Start by deciding on the type of cover you’ll need. One option is third party insurance, which only insures against damage and injuries to another car and not your own. You can include fire and theft with this option too. Comprehensive car insurance covers any type of damage to your vehicle as well as another car.

No-Claims discount

This is one of the most critical features of your car insurance policy. The amount that you’ll get varies hugely between providers, from 25% up to 58%, so check this out before deciding which car insurance to choose. Your no claims discount, (NCD), will inevitably be reduced if you make a claim, which is why many motorists use independent car repair companies for non-fault accidents or crash repairs.

You can pay extra for no claims discount protection, where your provider won’t reduce your no claims discount if you make a claim, though this will increase premiums and often isn’t available in the first few years of your insurance term.

What exactly is covered?

As well as damage repairs, fire and theft, you’ll need to check what else is covered with your car insurance policy. Some providers cover personal belongings, sat nav systems and legal costs resulting from a car insurance claim. Although in some cases, losing your no claims discount can be more costly than replacing some personal belongings yourself.

Age matters

Many car insurance providers insist on age limits and will only insure people over a minimum age and under a maximum age. Car insurance is much more expensive for younger drivers so it’s worth shopping around; young drivers can now save money on some policies if they agree to install safe driving tracking technology in their car, and agree not to drive at night.

Additional drivers

If you are likely to be sharing your car with a spouse or relative, you can add a named driver to your insurance policy. This named driver will be able to drive the car without needing a separate policy. Bear in mind that these named drivers don’t have the usual third-party cover to drive other cars.

Once you’ve checked all the small print, it’s time to choose your insurance provider. The website Which? has an online directory of recommended providers who are all assessed by Which? themselves and have to achieve high levels of customer satisfaction and be regulated by the Financial Services Authority. This is a great place to start, but don’t forget to read all of the small print!

End article.

Have you been in an accident that was not your fault? Would you like your car repaired without affecting your no claims bonus and without raising your renewal premiums? Click here to start your claim today.